If you bought a house with no maintenance issues big or small, let us know. That would be one for the record books. In reality, most homeowners find a problem, quirk, shortcoming, whatever, within the first couple of months.

To actively ferret out your home’s trouble spots and head off headaches, know the right questions to ask before you buy. That doesn’t mean potential problems go away, but you’ll have eyes wide open and can adjust your budget accordingly.

And if you’ve already settled in, getting answers to these key questions will help you get to work putting the shine on your castle. Ask the previous owner, your agent, and your new neighbors for helpful answers.

1. Has There Ever Been a Busted Pipe?

A broken pipe isn’t rare; in fact, water damage caused by a frozen or burst pipe is a leading cause of homeowners insurance claims, at around 22% of all home insurance losses, according to the Insurance Information Institute.

What bursts? Typically exposed water pipes in unheated basements and crawl spaces, along with exterior faucets.

Another prime suspect of water damage: old washing machine hoses.

A good inspector usually can tell if water damage has occurred, and any damage should be disclosed by the previous owner at the time of sale. Nevertheless, you should:

- Make sure exposed pipes in unheated areas are protected with pipe insulation.

- Install frost-proof spigots on all exterior faucets. The spigots let you put a shutoff valve inside your home so freezing isn’t likely.

- Check that washing machine hoses are in good condition and replace, if necessary, with braided steel hoses with brass fittings ($11 to $18 for a 5-foot hose). They’re much stronger and longer lasting than rubber hoses.

The big fallout from water damage is moisture problems you won’t see — behind drywall and trim — which can lead to mold. If you know there’s been a major leak, a mold remediation pro ($200 to $600) will tell you if mold is present and the steps required to remove it.

2. How Old is the Roof?

Knowing the approximate age will give you a good idea of how soon you’ll face — and need to budget for — repairs or replacement. A new roof is no small matter: The “2015 Remodeling Impact Report” from the NATIONAL ASSOCIATION OF REALTORS® pegs the median national cost of an asphalt roofing replacement at $7,600.

The most common type of roofing — regular asphalt shingles — needs to be replaced after 15 to 20 years. Here are estimated average life spans for other types of roofing materials:

- Top-of-the-line (architectural) asphalt shingles: 24 to 30 years

- Metal (galvalume): 30 to 45 years

- Concrete tile: 35 to 50 years

- Wood shakes: 20 to 40 years

If you don’t know the age of your asphalt roofing, use these general guidelines to determine if new shingles are in order:

1. Sand-like roofing granules accumulate in the bottoms of gutters and flow out through downspouts, but otherwise the roofing looks in good shape. Inspect for deterioration in spring and fall.

2. Bare spots begin to appear where patches of protective granules have worn away, and the edges of shingles start to curl — a strong signal that you need new roofing.

3. Shingles become brittle and begin to crack and break. You might be able to replace a few. But if roofing nail heads become exposed (that is, they’re no longer hidden by the overlapping shingles), an expensive roof leak is likely.

Tip: Know how many layers of roofing your house has. Most building codes allow two layers (because of weight concerns): the original roofing, and one re-roofing layer over that.

3. Any Infestations of Termites, Carpenter Ants, or Other Pests?

This should be disclosed by the previous owner at time of sale. But even if the owner dealt with a past infestation — and can offer proof, such as a receipt for pest control — that doesn’t mean the little buggers have been totally eliminated.

Whatever conditions made your house ripe for infestation in the first place — a slow leak under the house, soft rotting wood that attracts insects — may still be present. Plus, many infestations aren’t confined to one house. It may be a neighborhood-wide problem.

Be proactive, because the average cost of a termite extermination treatment around the perimeter of a 2,500-square-foot house is $1,700 to $3,200. Repairs to wooden framing, sheathing, and siding can run from hundreds to thousands of dollars.

You should:

- Ask neighbors about any problems they’ve had with pests.

- Seal cracks and holes around your house.

- Keep attics, basements, and crawl spaces dry and well-ventilated.

- Make sure gutters and downspouts are in good repair, and that the soil around your foundation slopes away from your house at least 6 inches over a 10-foot distance.

- Repair or replace any rotted wood.

- Keep firewood and lumber piles at least 20 feet from your home.

4. Any Pets Buried in the Backyard?

For a grieving homeowner, it can make sense to bury Bosco in his favorite spot under the old oak tree.

On one hand, we sympathize; on the other, it’s kinda creepy. If you didn’t know, you might go out to with a shovel to plant a bunch of hostas. Surprise! You’ve unearthed Bosco.

If you ask this question and the answer is yes, you can:

- Ask where the animal is buried and simply avoid gardening in that spot.

- Ask the previous owner to remove the remains.

- Remove the remains yourself.

If the previous owner refuses your request, you’re not exactly on firm legal ground. Disclosure laws are hazy on this point. Check your state’s disclosure laws.

Most states allow pets to be buried in a yard as long as they’re a prescribed distance from waterways, water sources, and nearby residences (usually 100 to 200 feet); the animal is buried 6 inches to 2 feet in depth; and there’s some sort of precaution (a kitty coffin or a covering of stones would do the trick) so the carcass can’t be dug up by animals. Major cities may not allow any type of pet burial. Aask your county’s board of health and animal control agency for local regulations.

If you find out there’s a buried pet and want it removed, write a letter to the previous owner requesting removal — and keep a copy. If you decide to go to court, you’ll want a document that proves you made the request.

Better yet, hire an attorney to draft a letter. A letter from a lawyer commands attention.

The bottom line: If you drag this all the way to court, it’s probably not worth the aggravation and bad blood. A better solution: Hire someone to dig out the remains and take them away, or do it yourself. Then plant those hostas.

5. Any Paranormal or Nefarious Activity?

Maybe for the sake of party conversation, you’re hoping the answer is yes. Regardless, ask.

Haunted houses fall into the category of what real estate pros call “stigmatized houses” — homes that have been the site of happenings like:

- Ghost sightings and other paranormal activity

- A murder or suicide

- A death due to an accident or unusual disease

- A meth lab

Again, real estate disclosures aren’t consistent. About half of all states have disclosure requirements for stigmatized houses, although most don’t include ghosts.

If the seller reveals the house to be stigmatized, you’ll have negotiating power. A stigmatized house generally sells for 10% to 25% below market value.

A meth lab carries the risk of residual toxic chemicals. If you suspect that kind of sordid history but it’s not being disclosed, you can check old news accounts or ask the local police for records of arrest.

You’ll want to ask the seller and your real estate agent directly if you’re concerned about ghosts and ghouls, and check your local real estate laws to get the local lowdown on disclosing paranormal activity.

6. What are Monthly Utility Costs?

You can’t get away from paying utilities, so know what your monthly budget is up against. Be sure to get an average cost — not the lowest monthly bill — and ask when peak months are.

While you’re at it, ask what kind of energy sources your house appliances use — gas, electric, propane, or a combination. That’ll help you understand where you might upgrade to energy-efficient appliances to save energy costs.

Remember that energy savings starts with the simplest of tasks, like sealing air leaks.

7. Has the Sewer Ever Backed Up?

As properties age and trees and other plants get bigger, roots find their way into sewer lines between a house and the street, causing clogs. It’s a mess for sure, and most homeowner insurance policies don’t cover damage from backed-up sewers.

Plan to have the sewer line cleared (about $150) every other year.

For $40 to $50 per year, you can add an endorsement to your insurance policy to cover damage from a backed-up sewer.

8. Is There Documentation on Warranties?

If the previous owners were conscientious enough to stash warranties and appliance manuals, be sure to get them.

If you get the paperwork, look for purchase dates on major appliances, so you’ll know how old they are and when they might decide to poop out. If you’re ready to upgrade, you can I.D. which appliances are least energy efficient and target those first.

Tip: Keep all warranty cards and product manuals yourself. If you decide to sell, those records show you care about your house and become a marketing asset.

9. How Much Insulation is in the Attic?

After sealing air leaks and weatherstripping around doors and windows, adding insulation is one of the best ways to gain efficiency and keep your house cozy.

Knowing how much insulation you have lets you decide if an investment in more insulation is worth the cost. In colder regions, for example, a $1,500 attic insulation upgrade from R-11 to R-49 saves about $600 per year in energy costs, and you’ll see a payback in about three years.

The U.S. Department of Energy recommends adding more insulation if the thickness of your attic insulation is less than 11 inches (R-30).

Is the previous owner unsure? Peek in the attic. If the attic floor is insulated and you can see the tops of the ceiling joists, you should budget an insulation upgrade. If insulation was installed between the roof rafters — and you can see the edges of the rafters — you can beef up the insulation by covering over the rafters with rigid insulating foam board.

10. How Big is the Water Heater?

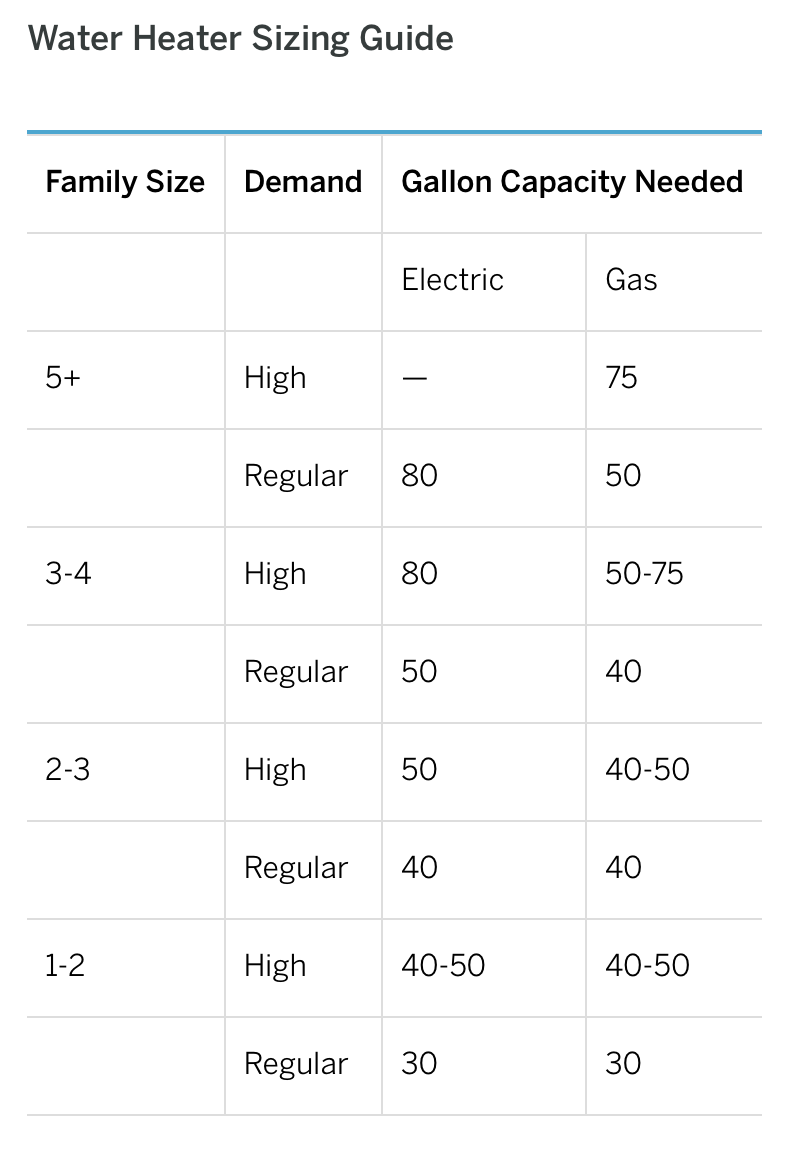

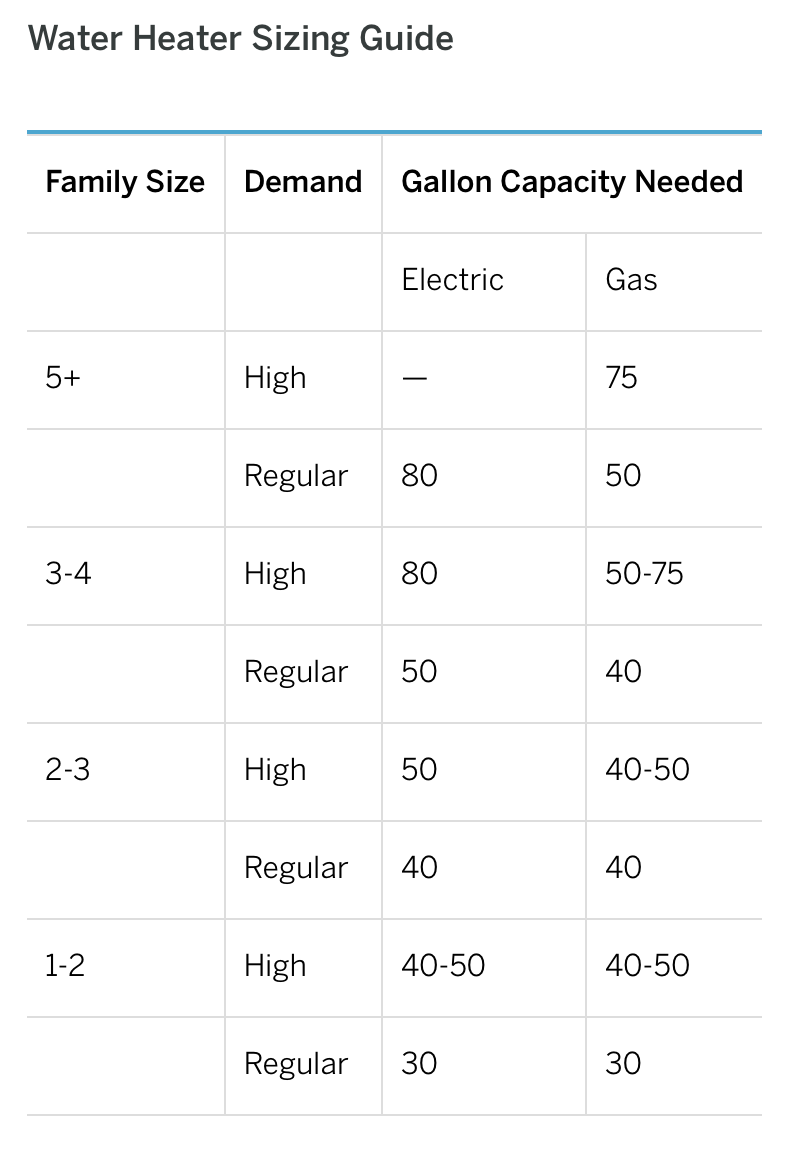

To avoid a family rebellion, make sure your water heater is big enough to cover the needs of your household. Here’s a helpful guide from Johnson, Tenn.-based manufacturer American Water Heaters:

Most water heaters have a life expectancy of about 13 years. A new high-efficiency water heater costs $900 to $2,000, depending on the size and model you choose.

11. When Was the Last Time the Septic Tank Was Pumped?

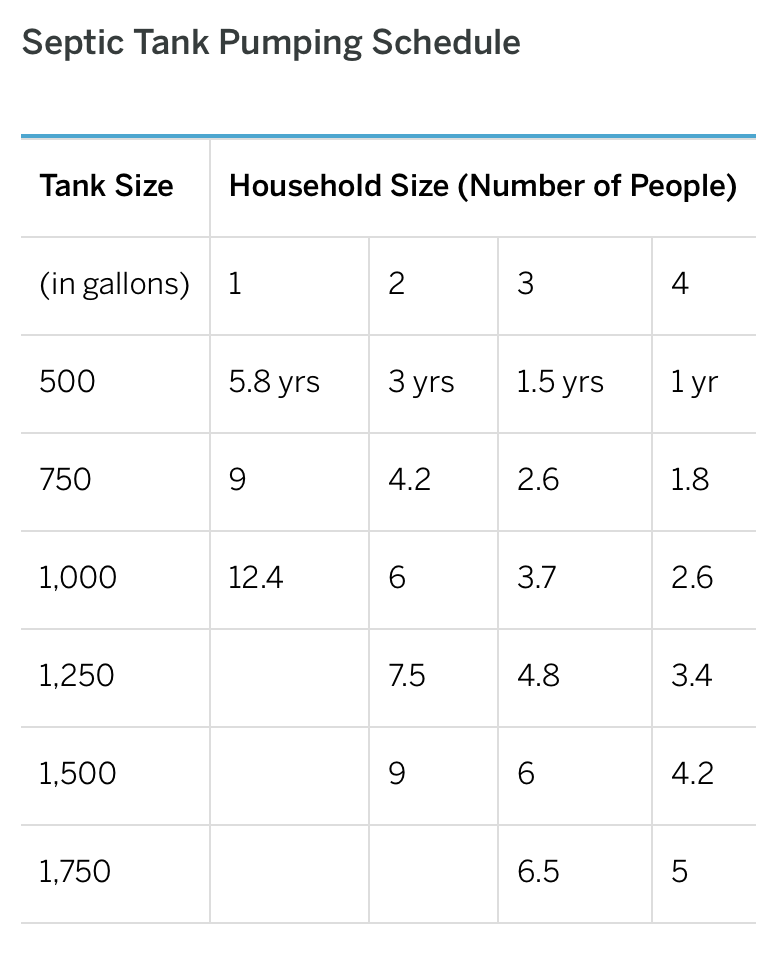

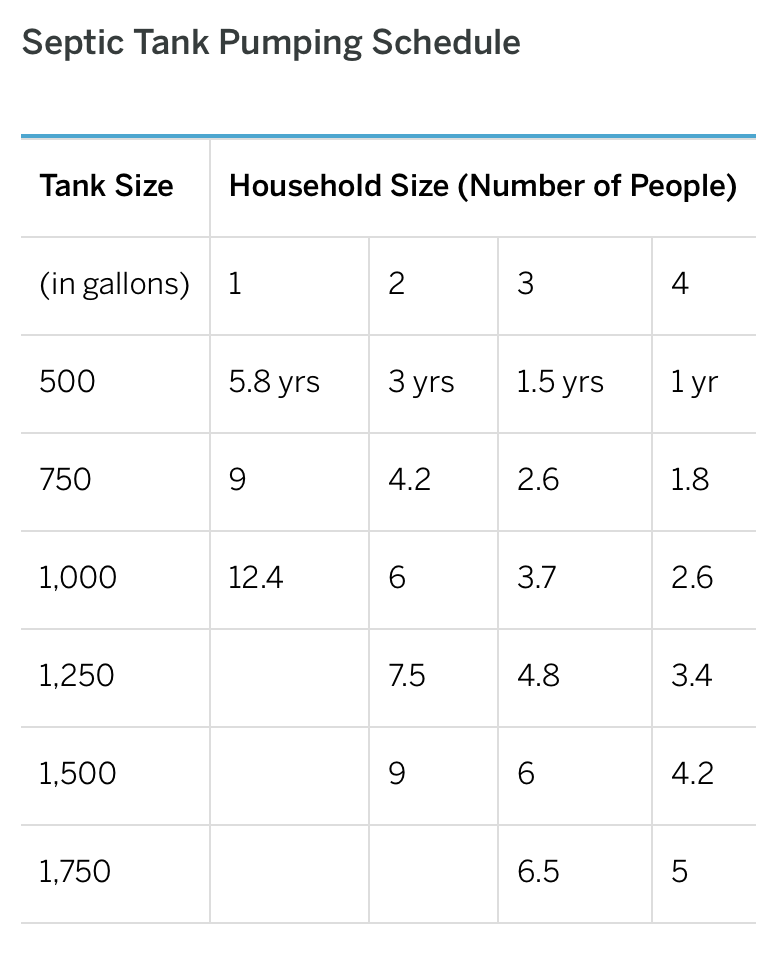

A typical septic system should be pumped every three to five years, according to the U.S. Environmental Protection Association. But the number of people in the house can affect that recommendation. We like this chart from septic installer Van Delden in San Antonio, showing about how often (years) you should pump based on capacity. A pumping costs $200 to $300.

12. Will My SUV Fit in the Garage?

It’s a fairly common doh! moment “Many garages are too low to accommodate the height of a big, newer vehicle.”

Cabinets and workbenches can shorten overall garage space, too, making length an issue.

With full-size SUVs and trucks nearing 20 feet in length and almost 7 feet tall when equipped with a roof rack, sizing up the garage space is a good idea before you buy.

Worst case: You buy without checking and come sailing happily home for the first time to discover — too late — your Chevy Suburban is too tall to fit in the garage.

Knowing everything you can about your home gives you a leg up on surprises, lets you budget smartly, and gives you royal satisfaction with your new castle.

Source: House Logic by John Riha